Common Sense from The Commonwealth

Check out our insightful Blogs on the current state of the Mortgage Industry

The Economic Edge: Why Contract Mortgage Processing Beats Traditional In-House Methods

Discover why contract mortgage processing outperforms in-house methods in 2026: up to 40%+ cost savings, effortless scalability, expert efficiency, and reduced risks. See how The Commonwealth Group delivers onshore, flexible solutions.

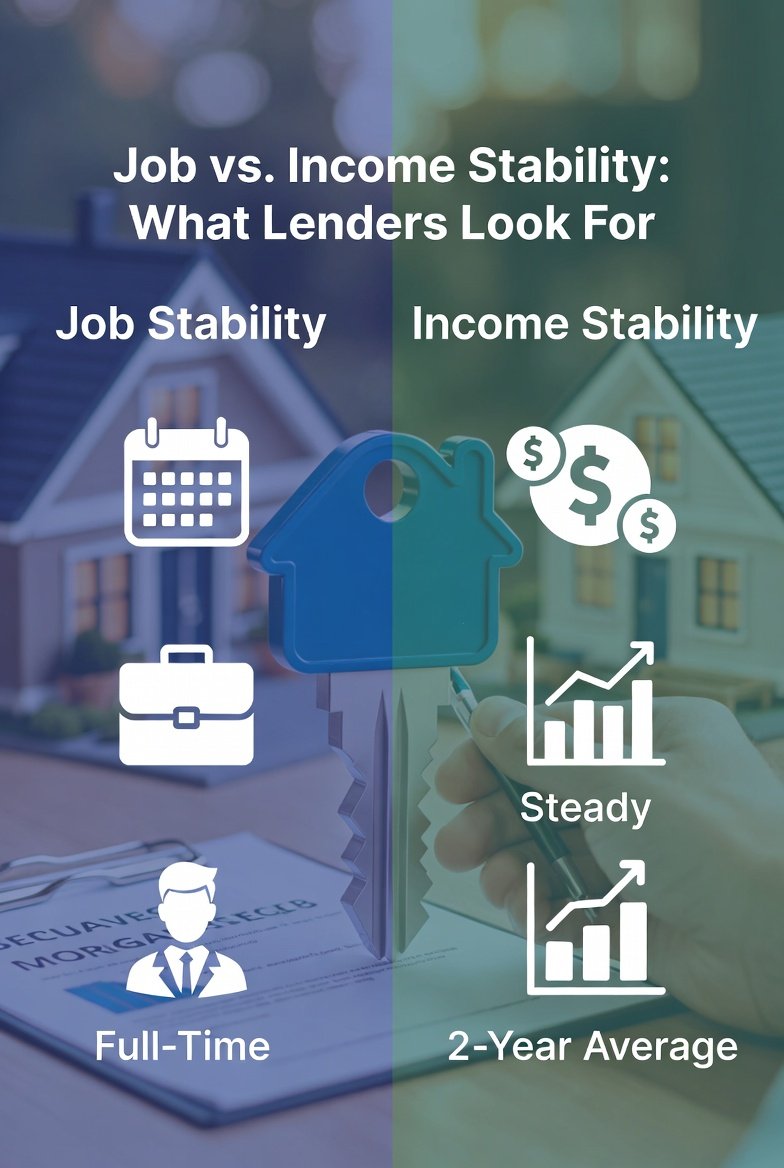

Navigating Mortgage Approval: Job Stability vs. Income Stability

Explore the key differences between job stability and income stability in mortgage approval. Learn how lenders evaluate them and how The Commonwealth Group helps streamline underwriting for reliable outcomes.

Fannie Mae and Freddie Mac are Serious about Cybersecurity Regs

Fannie Mae and Freddie Mac are now enforcing strict cybersecurity and information security requirements on all seller/servicers. Learn the deadlines, what’s required, and how The Commonwealth Group helps mortgage companies comply- before it’s too late.

Navigating Risks in Mortgage Underwriting: Risk Management vs. Risk Elimination

Risk elimination in mortgage underwriting rejects any imperfect loan to avoid all risk, while risk management assesses and mitigates risks to enable responsible lending and portfolio growth.

Flexibility Drives Profitability - Value Drives Success

In the mortgage world, chasing the cheapest vendor often leads to hidden headaches like delays, compliance fines, and rework—while choosing a flexible, expert partner like The Commonwealth Group delivers faster closings, lower long-term costs, strong risk protection, and real profitability through one-stop services including underwriting, condo reviews, and compliance.

Dear Santa: The Commonwealth Group Christmas Wish List for a Brighter 2026

On behalf of every professional in the Mortgage Industry, this is our Wish List to Santa- From The Commonwealth.