Navigating Risks in Mortgage Underwriting: Risk Management vs. Risk Elimination

In the dynamic world of mortgage lending, understanding how to manage risk is crucial for lenders, borrowers, and service providers alike. At The Commonwealth Group, we specialize in end-to-end fulfillment services for the mortgage industry, including underwriting, processing, and quality control. Our expertise helps clients maintain profitability while navigating complex regulatory landscapes. Today, we are diving into a key distinction: risk management versus risk elimination in mortgage underwriting. While both approaches aim to protect lenders from potential losses, they differ significantly in philosophy, application, and outcomes.

What is Risk Elimination in Mortgage Underwriting?

Risk elimination is a zero-tolerance strategy. It involves identifying potential risks in a loan application and outright rejecting any that do not meet stringent criteria. Think of it as building an impenetrable fortress—nothing gets through unless it is flawless.

In practice, this might look like:

Declining loans for applicants with credit scores below a hard cutoff (e.g., 700).

Avoiding properties in high-risk areas, such as flood zones, without exception.

Requiring full documentation for every aspect of income, assets, and employment, with no room for alternative verification methods.

The appeal of risk elimination is clear: it minimizes defaults and foreclosures by only approving "sure bets." However, this approach can be overly conservative. In a competitive market, it might lead to missed opportunities, reduced loan volumes, and alienation of qualified borrowers who do not fit perfect profiles and in extreme cases a potential for an allegation of redlining or other fair lending violation.

What is Risk Management in Mortgage Underwriting?

In contrast, risk management adopts a more nuanced, proactive stance. Rather than avoiding risk entirely, it focuses on identifying, assessing, and mitigating risks to acceptable levels. This allows lenders to extend credit responsibly while balancing caution with growth.

Key elements include:

Risk Assessment: Using tools like credit scoring models, debt-to-income ratios, and automated underwriting systems (e.g., Fannie Mae's Desktop Underwriter) to quantify risk.

Mitigation Strategies: Implementing compensating factors, such as requiring higher down payments for lower credit scores or additional reserves for variable-income borrowers.

Ongoing Monitoring: Post-closing reviews and quality control to catch emerging issues early.

At The Commonwealth Group, our underwriting services embody this approach. We conduct thorough reviews while applying flexible guidelines that align with investor requirements.

This method promotes inclusiveness, enabling loans for a broader range of borrowers, including first-time homebuyers or those in underserved communities. It also supports innovation, like incorporating alternative data (e.g., rent payment history) to better evaluate creditworthiness.

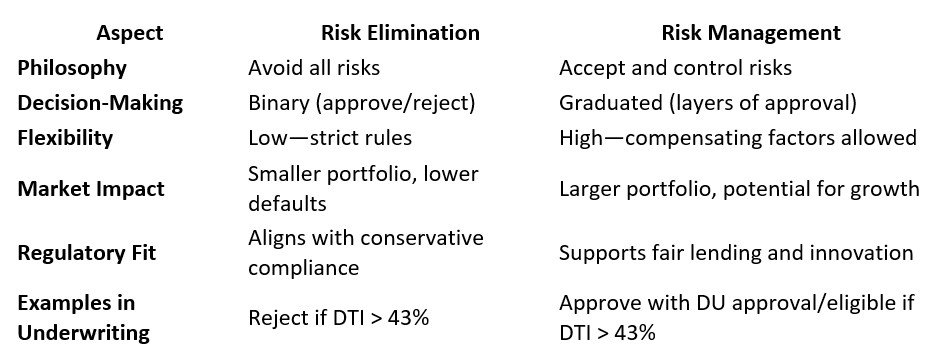

Key Differences and Their Impact on Mortgage Underwriting

To highlight the contrast, here is a quick comparison:

The choice between these approaches depends on a lender's risk appetite, market conditions, and regulatory environment. Risk elimination might suit smaller institutions focused on stability, but it can stifle growth. Risk management, however, is increasingly favored in today's data-driven era, where advanced analytics allow for precise risk pricing.

That said, neither is foolproof. Over-reliance on elimination can lead to redlining concerns, while poor management might increase default rates. The sweet spot? A hybrid model that eliminates unacceptable risks (e.g., fraudulent applications) while managing others effectively.

Why This Matters for Lenders Today

In an era of rising interest rates and economic uncertainty, effective risk handling is more important than ever. According to industry data, well-managed risks can reduce delinquency rates by up to 20% without sacrificing volume. At The Commonwealth Group, our fulfillment and consulting services help customers strike this balance, from underwriting to portfolio due diligence to regulatory audits.

If you are a lender refining your underwriting processes or other parts of your operation, remember risks are not enemies to be eradicated—they are opportunities to be harnessed.

Interested in optimizing your mortgage operations? Visit www.thecommonwealth.net to learn more about our services, or contact Martin Luplow at [email protected] or Nick De Santis at Condoanalytics - [email protected] - for a consultation. Let us manage risks together for a more profitable future.

The Commonwealth Group is Innovative Services for the Mortgage Industry.

West Beibers, CMB, AMP, CRU

Chief Executive Officer

The Commonwealth Group Companies