Common Sense from The Commonwealth

Check out our insightful Blogs on the current state of the Mortgage Industry

Fannie Mae Information Security Requirements

Explore Fannie Mae's 14 key information security domains in the Business Resiliency Supplement. Learn how administrative, technical, and operational controls protect sensitive borrower data for lenders and servicers.

Matters of Trust: Mortgage Lending and Properties Held in a Trust

Can a trust hold title to a mortgaged home? In 2026, revocable living trusts are widely accepted by Fannie Mae, Freddie Mac, FHA & VA. Explore rules, docs needed & how The Commonwealth Group helps lenders.

The Economic Edge: Why Contract Mortgage Processing Beats Traditional In-House Methods

Discover why contract mortgage processing outperforms in-house methods in 2026: up to 40%+ cost savings, effortless scalability, expert efficiency, and reduced risks. See how The Commonwealth Group delivers onshore, flexible solutions.

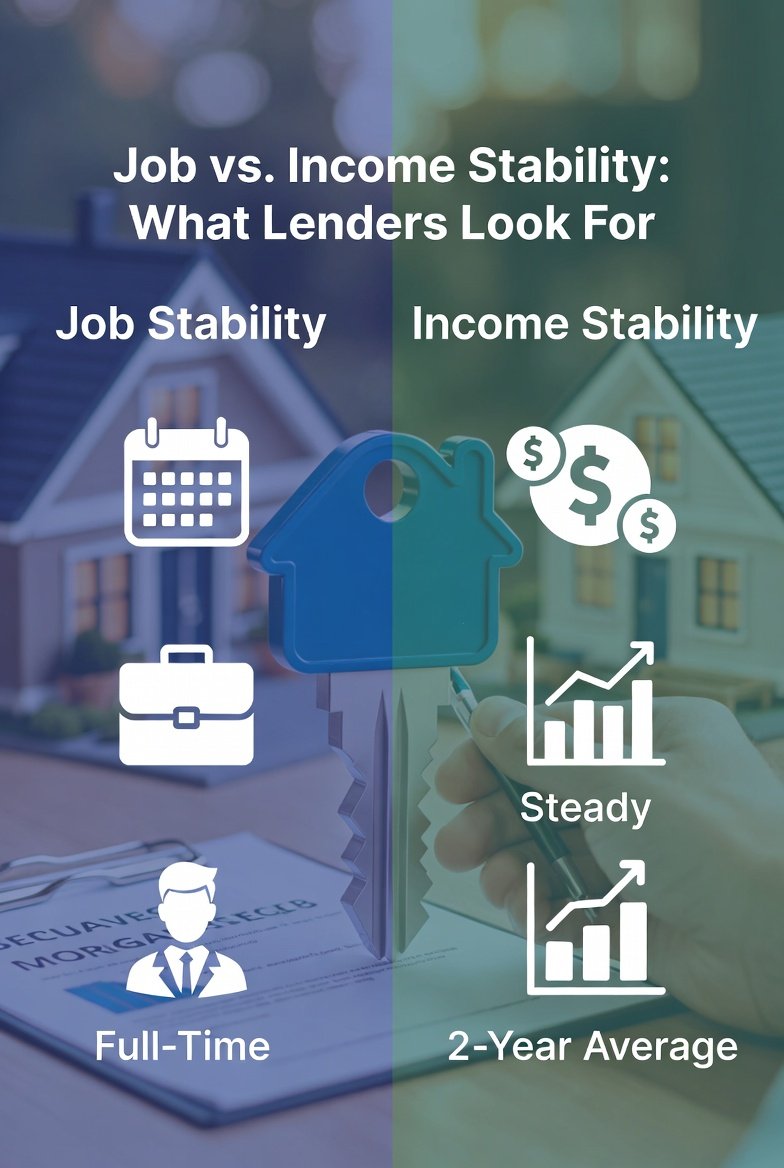

Navigating Mortgage Approval: Job Stability vs. Income Stability

Explore the key differences between job stability and income stability in mortgage approval. Learn how lenders evaluate them and how The Commonwealth Group helps streamline underwriting for reliable outcomes.

Fannie Mae and Freddie Mac are Serious about Cybersecurity Regs

Fannie Mae and Freddie Mac are now enforcing strict cybersecurity and information security requirements on all seller/servicers. Learn the deadlines, what’s required, and how The Commonwealth Group helps mortgage companies comply- before it’s too late.

Navigating Risks in Mortgage Underwriting: Risk Management vs. Risk Elimination

Risk elimination in mortgage underwriting rejects any imperfect loan to avoid all risk, while risk management assesses and mitigates risks to enable responsible lending and portfolio growth.

Artificial Intelligence vs. Real Intelligence: Striking the Right Balance in the Mortgage Industry

The Commonwealth Group emphasizes integrating AI's efficiency with real human intelligence's judgment to optimize mortgage processes, ensuring compliance, risk mitigation, and superior client service.

Cybersecurity Is Strategic

Cybersecurity decisions impact the entire organization. They must be strategic, guiding long-term outcomes like the WWII "defeat Germany first" approach. Integrate security from idea inception to influence design, processes, and culture. Prioritize it to ensure availability, confidentiality, and data integrity.

Flexibility Drives Profitability - Value Drives Success

In the mortgage world, chasing the cheapest vendor often leads to hidden headaches like delays, compliance fines, and rework—while choosing a flexible, expert partner like The Commonwealth Group delivers faster closings, lower long-term costs, strong risk protection, and real profitability through one-stop services including underwriting, condo reviews, and compliance.

Cyber Risk is Systemic

Cyber risk is like a domino effect. Today’s businesses rely on so many connected pieces (cloud services, apps, the internet, and even employees clicking the wrong email) that a problem in one spot can quickly spread and hurt the whole company. Learn how you can help protect against it, especially in the mortgage industry which is part of the bigger financial world.

The Stifling Grip of Dodd-Frank: How Regulations Are Hindering Innovation in Mortgage Affordability

The Dodd-Frank Act, intended to stabilize the financial system post-2008 crisis, has instead imposed rigid regulations that stifle mortgage innovation, increase compliance costs, and hinder affordability for everyday homebuyers. The Commonwealth Group is here to be the voice that advocates for mortgage empowering policies.

Why Quality Control is the Unsung Hero of the Mortgage Industry

Discover why quality control (QC) is the essential, behind-the-scenes force in the mortgage industry that ensures compliance, prevents fraud, minimizes risks, and builds trust for lenders and borrowers alike.

Everyone Owns Cyber Risk: Shared Responsibility in Mortgage Cybersecurity

In the mortgage industry, cyber risk cuts across every department, from board oversight to compliance with GLBA Safeguards Rule. True protection requires everyone to own it, not just the CISO.

HUD Proposes Rescinding Disparate Impact Rule: Impacts for Mortgage Lenders 2026

HUD's January 2026 proposal to rescind disparate impact regulations under the Fair Housing Act could reduce burdens for mortgage lenders. Explore implications for fair lending compliance, litigation risks, and next steps from The Commonwealth Group.

What is Cybersecurity? A Simple Guide for Mortgage Lenders

What is cybersecurity? A straightforward explanation of cybersecurity risk management, the CIA triad, and why mortgage lenders need it for GLBA Safeguards Rule and Regulation S-P compliance. Learn more here from The Commonwealth Group.

Mortgage Mistakes Fannie Mae Flagged Most in 2025 - And How Borrowers & Lenders Can Avoid Them

Fannie Mae's 2025 Quality Insider reviews highlighted persistent defects like undisclosed liabilities, occupancy misrepresentation, income miscalculations, and property issues—here's how lenders and borrowers can prevent them for smoother originations in 2026.

Trump's Bold Moves On Housing - The Commonwealth Group Perspective

President Trump's January 2026 bold directives on housing aim to lower mortgage rates and boost affordability. The Commonwealth Group views these moves as a catalyst for increased originations, refinancing, and a healthier housing market despite potential challenges.

Why Outsourcing Contract Processing is a Game-Changer for Mortgage Lenders in 2026

In 2026, mortgage origination volumes are projected to reach $2.2 trillion. Outsourcing contract processing to 100% US-based providers like The Commonwealth Group emerges as a strategic way for lenders to grow more than ever.

Embracing the Future: The Commonwealth Group and CondoAnalytics Look Ahead to 2026

As we step into 2026, The Commonwealth Group and CondoAnalytics are excited to lead the mortgage industry forward with our guiding pillars: Respect, Innovation, and Trust.

Dear Santa: The Commonwealth Group Christmas Wish List for a Brighter 2026

On behalf of every professional in the Mortgage Industry, this is our Wish List to Santa- From The Commonwealth.