Understanding APR Calculation for Mortgage Loan Officers

Mortgage Loan Officers are the bridge between complex financial concepts and everyday homebuyers. One of the most crucial yet frequently misunderstood elements in the mortgage process is the Annual Percentage Rate (APR). Unlike the straightforward interest rate, APR provides a more comprehensive view of the loan's true cost. In this blog post, we will break down what APR is, how it differs from the interest rate, the components involved, and—most importantly—how to calculate it – and then to explain it to homebuyers. Mastering APR calculations can help a Loan Officer build trust and close deals more effectively.

What is APR and Why Does It Matter?

APR stands for Annual Percentage Rate, representing the total yearly cost of borrowing money for a mortgage, expressed as a percentage. It goes beyond the base interest rate by incorporating additional fees and costs associated with the loan. This makes APR a valuable tool for comparing different mortgage offers on an apples-to-apples basis.

For loan officers, understanding APR is essential because federal regulations, like the Truth in Lending Act (TILA), require its disclosure to borrowers. It helps clients see the bigger picture: a loan with a lower interest rate but high fees might end up costing more overall than one with a slightly higher rate but lower upfront costs. By explaining APR clearly, a Loan Officer can guide clients toward the most cost-effective option, potentially saving them thousands over the loan's life.

Interest Rate vs. APR: Clearing Up the Confusion

The interest rate is the percentage charged on the loan's principal amount—the amount borrowed. It is used to calculate the monthly principal and interest payments. For example, on a $100,000 loan at 6% interest, the payments are based solely on that rate.

APR, on the other hand, includes the interest rate plus other lender-imposed costs, such as origination fees, discount points, and certain closing costs. This results in an APR that is typically higher than the interest rate. Think of the interest rate as the "sticker price" and APR as the "total cost of ownership." If a mortgage has no fees, the APR would equal the interest rate, but that is rare in practice.

A key point: APR does not include all costs, like appraisals, title insurance, or credit reports, as lenders have discretion over what's factored in. It is also calculated assuming the borrower holds the loan for its full term, which can make it less accurate for adjustable-rate mortgages (ARMs) or if the borrower refinances early.

Components Included in APR

To calculate APR accurately, it has to start with knowing the costs that go into it. Typically, these include:

Interest Rate: The base rate on the loan.

Origination Fees: Charges for origination or processing the loan.

Discount Points: Optional fees paid upfront to lower the interest rate.

Other Prepaid Finance Charges: This can include items such as underwriting fees, administrative fees, and prepaid interest.

Mortgage Insurance Premiums: For loans with less than 20% down payment, like FHA MIP or PMI for a conventional mortgage.

Items usually excluded: Third-party fees (e.g., home inspections), variable costs, or penalties. Always check items with the compliance department for the exact list.

How to Calculate APR: A Step-by-Step Guide

Calculating APR is not as simple as adding fees to the interest rate—it is the effective rate that accounts for how those costs are spread over the loan's life. The official method is outlined in Appendix J of Regulation Z, but it involves solving for the internal rate of return (IRR) on the loan's cash flows. In practice, lenders use software, but understanding the mechanics is key for loan officers.

Here is a conceptual breakdown:

Determine the Net Loan Proceeds: Subtract the total fees (prepaid finance charges) from the principal amount. This is what the borrower effectively receives.

Calculate the Monthly Payment: Use the nominal interest rate to find the fixed monthly principal and interest payment.

Solve for the APR: Find the interest rate that, when used to discount the monthly payments back to present value, equals the net proceeds. This is typically done iteratively.

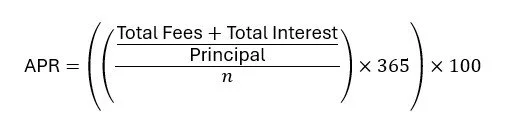

The basic formula for APR is:

Where is the number of days in the loan term. However, for amortizing loans like mortgages, this is a simplification—the full calculation uses the payment stream.

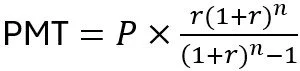

A more practical approach for fixed-rate mortgages:

Compute the monthly payment based on the interest rate.

Adjust the principal downward by the fees.

Use a financial calculator such as the HP-12c to find the new rate that yields the same payment on the adjusted principal.

Example Calculation

Let us walk through a real-world example. Suppose a client takes out a $100,000 mortgage at 6% interest for 30 years, with $2,000 in total fees (origination and points).

Step 1: Monthly interest rate = 6% / 12 = 0.5%.

Step 2: Monthly payment = $599.55 (calculated using the amortization formula, where P is principal, r is monthly rate, n is months):

Step 3: Net proceeds = $100,000 - $2,000 = $98,000.

Step 4: Solve for the monthly rate where the present value of 360 payments of $599.55 equals $98,000. This yields a monthly rate of approximately 0.5158%, or an annual APR of 6.1895%.

In this case, the APR is about 0.1895% higher than the interest rate, reflecting the impact of the fees. For larger fees or shorter terms, the difference would be more pronounced.

Tools like Excel's RATE function: =RATE(360, 599.55, -98000) * 12 * 100 can also be used. This iterative method mirrors how software computes it.

Tips for Mortgage Loan Officers

Explain Transparently: Use simple analogies—like comparing APR to the full price of a car including taxes and fees—to help clients grasp it. Show side-by-side comparisons of loans.

Highlight Limitations: Remind clients that APR assumes full-term repayment and may not capture ARM adjustments or early payoffs.

Use Calculators: Leverage online tools from sites like Bankrate or NerdWallet for quick estimates but always verify with lender software.

Compliance Check: Ensure all disclosures are accurate; misstating APR can lead to regulatory issues as well as additional costs to the lender.

Client Education: Emphasize that while APR is useful for comparison, the best loan depends on their financial goals, like cash flow or long-term savings.

Conclusion

Mastering APR calculations empowers Loan Officers to provide better advice and foster client loyalty. By demystifying this key metric, it will help lenders not only comply with regulations but also help borrowers make informed decisions. Next time a client asks, "What's the real cost of this mortgage?", a Loan Officer will be ready with a clear, confident explanation.

The Commonwealth Group is here to assist our lender partners with our services and also with training. Commonwealth has the expertise and the services your company needs, whether a bank, a credit union, or independent mortgage banker, to face training challenges as well as our regular services - Contract Underwriting; Contract Processing; Quality Control; Condo Project Review (through Condoanalytics); and Technology Services. All of these are at The Commonwealth Group to help your company achieve innovative and cost-saving solutions.

To get started and see what Commonwealth can do for your company, contact Martin Luplow at [email protected] for more information.

The Commonwealth Group is Innovative Services for the Mortgage Industry.

West Beibers, CMB, AMP, CRU

Chief Executive Officer

The Commonwealth Group Companies