Mortgage Trends for 2026: A Gradual Thaw in a Cooling Market

As we wrap up 2025, the mortgage landscape feels like a house finally warming up after a long winter- still chilly, but with signs of spring on the horizon. After years of sky-high rates and affordability squeezes that locked many buyers out, 2026 looks poised for a modest reset. Do not expect a return to the sub-3% glory days of the pandemic era; instead, anticipate steady, incremental improvements driven by Federal Reserve cuts, cooling inflation, a retreat in mortgage spreads, and a softening labor market. Drawing from forecasts by heavyweights like Fannie Mae, Redfin, and the National Association of Realtors (NAR), here is what homebuyers, sellers, and refinancers need to know about the year ahead.

Mortgage Rates: Low-6% Stability with a Downward Drift

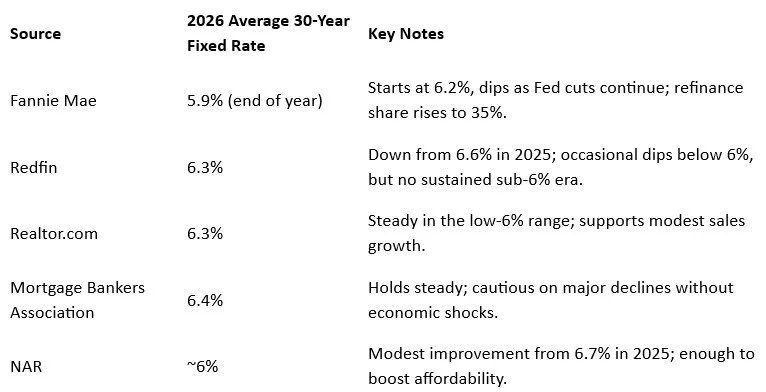

The big question on everyone's mind: Will rates finally drop enough to unlock the market? The consensus is yes, but not dramatically. After averaging around 6.64% for 30-year fixed mortgages in 2025, experts predict a gentle slide into the low-6% range next year. Here is a snapshot of key projections:

These forecasts hinge on the Fed's trajectory. With the federal funds rate projected to end 2026 around 3%—down from the current 3.75%-4%—further cuts are likely if inflation stays tame and unemployment edges up. However, bond markets and the 10-year Treasury yield (which mortgages closely track) will temper any wild swings. A sharper economic downturn could push rates lower toward 5.5%, but that is the "X factor" no one is betting on heavily.

For 15-year fixed loans, expect rates about 0.5%-0.8% below 30-year averages, hovering around 5.3%-5.5%. Adjustable-rate mortgages (ARMs) might see a niche resurgence if buyers gamble on further rate drops, but fixed remains king for most.

Refinancing Boom: Unlocking the "Golden Handcuffs"

One of 2026's bright spots? A surge in refinances. With rates easing, homeowners locked into pandemic-era sub-4% loans may finally trade up without sticker shock. Fannie Mae eyes single-family originations jumping to $2.32 trillion in 2026, up from $1.85 trillion this year, with refinances claiming 35% of the pie. Redfin predicts a 30%+ annual increase in refinance volume, hitting $670 billion by year-end.

This "rate reset" could free up inventory too- think more listings from borrowers who wish to move up and who no longer fear doubling their payments. But it is not all rosy: Cash-out refinances may stay muted, as many prefer tapping equity via home equity lines of credit (HELOCs) to avoid resetting to higher rates. For borrower’s sitting on a low-rate mortgage, even a 0.5% drop can save thousands over the loan's life.

The Broader Housing Ripple: Sales Up, Prices Steady

Mortgages do not exist in a vacuum- they are the engine of the housing market. With rates stabilizing, expect a gentle uptick in activity:

Home Sales: Existing sales could rise 1.7%-9%, reaching 4.13-4.51 million units. New construction stays strong, with builders using rate buydowns to lure buyers.

Home Prices: Growth cools to 1%-4% nationally, with median prices up 2.2% but inflation-adjusted dips in some spots. A "two-speed" market emerges: Northeast/Midwest sees firmer prices due to tight supply, while Sun Belt metros like Austin and Tampa cool with rising inventory.

Inventory: Up 8.9% year-over-year, hitting 4.6 months of supply—still seller-leaning but more balanced than 2025's frenzy.

Affordability will inch forward as wages grow 4% (outpacing the 1%-2% price hikes), dropping typical payments to 29.3% of median income for the first time since 2022. Rents will soften too, down 1% nationally, easing pressure on would-be buyers stuck renting.

Emerging Trends: Tech, Multigenerational Living, and Policy Wildcards

While rates are important, at the Commonwealth we are seeing these new dynamics already in the market:

Non-QM Loans on the Rise: Over 10% of applications already, these flexible products (for gig workers, investors) gain traction as traditional underwriting evolves.

Multigenerational Homes: With affordability woes, expect more garage conversions into in-law suites—Thumbtack (a home improvement website – www.thumbtack.com) calls it the top renovation trend for 2026 and beyond.

AI and Tech Integration: From AI-powered house hunting tools to lender use of AI. both homebuyers and lenders are making use of the productivity offered by AI.

Policy Shifts: Privatization talks for Fannie/Freddie could quickly affect costs; zoning and manufactured housing pushes aim to boost supply.

What It All Means

2026 will not be a housing revolution, but a welcome evolution. Rates in the low-6s dropping quickly into the 5.5% area signal relief after years of frozen markets. Redfin dubs this as the "Great Housing Reset"—slow, steady, and finally moving forward. For those of us who have survived the killing frost of the last 3-4 years, that sunshine feels good!

And as housing begins to grow again, The Commonwealth Group is still here is to assist our lender partners. Many companies are already responding to the current lending environment by seeking out the professionals at The Commonwealth Group and preparing for the coming market return. Commonwealth has the services your company needs, whether a bank, a credit union, or independent mortgage banker to be ready for the improving market. Contract Underwriting; Contract Processing; Quality Control; Condo Project Review (through Condoanalytics); Technology Services are all at The Commonwealth Group to help your company achieve innovative and cost-saving solutions for their customers.

To get started and see what Commonwealth can do for your company, contact Martin Luplow at [email protected] for more information.

The Commonwealth Group is Innovative Services for the Mortgage Industry.

West Beibers, CMB, AMP, CRU

Chief Executive Officer

The Commonwealth Group Companies